The average cost of car insurance for Volkswagen Tiguan S owners is $2,731 a year. However, exact rates vary from model to model: for instance, the New Gti Fahrenheit costs $242 more per year to insure than the Jetta Tdi Option Package 1. Show

Jump to:

The Tiguan is Volkswagen’s effort to combine steadfast German engineering with the distinctly American SUV. The result is fine-tuned handling, restrained yet elegant styling, and the power and performance you’d expect from Volkswagen’s legendary pedigree. In a market saturated with American and Japanese SUVs, the Tiguan is a true top contender and is now one of the most successful vehicles in Volkswagen’s arsenal.While the Tiguan S is the base model, it still retains a few high-tech touches typically reserved for higher trim levels, such as touch-sensitive controls on the steering wheel, heated seats, and phone connectivity, as well as a WiFi hotspot in the newest model year. So if you opt for the base model Tiguan S, you’ll never feel like you’ve sold yourself short.The Tiguan S may be on its way out, but it’s still important to keep yours protected and on the road for as long as possible with the right car insurance. Volkswagen Tiguan S car insurance costOne of the primary determining factors for your Volkswagen Tiguan S insurance rate is the age of your vehicle. Rates can vary by as much as $4 per year of car. Here's how much it costs to insure your Tiguan S by car year (and how much Jerry can save you when doing it):

If you drive a Volkswagen Tiguan S , you can expect your insurance costs to vary depending on trim level, upgrades, and the coverage level you select. Here's how your insurance cost compares to other similar cars: Best car insurance companies for your Volkswagen Tiguan SIf you drive a Volkswagen, you probably put a high value on the things Volkswagen does best: reliability, practicality, and quality that stands the test of time. You need the same things from your insurance coverage. You’ll need to find a company that offers the right options at the right price—and one that doesn’t waste your time with bad customer service. But every company is different, and comparing options can get overwhelming, fast. Shopping with Jerry is the most efficient way to nail down the best coverage at the best rate. It takes less than a minute to get competitive customized quotes from top-rated insurers, and you’ll be able to review and select coverage options in the app. Best of all, Jerry conducts regular price monitoring every six months to make sure you’re still carrying the best insurance. Take a look at the table below to see the options different insurance companies offer for Volkswagen Tiguan S drivers.

Compare car insurance quotes for Volkswagen Tiguan SBut with all the different insurance companies and coverage options out there, how do you find the right insurance? Easy: you download the Jerry app. As a licensed broker with over 55 partner companies, Jerry can find all the best coverage options for your Volkswagen in 45 seconds or less! With support from Jerry’s insurance experts, switching policies is close to effortless—with no unwanted phone calls, no duplicate paperwork, and no long wait times. See for yourself what real Jerry customers saved by shopping for Volkswagen insurance in the app!

20 people from Jerry switched with Jerry to Safeco in the past 7 days. Last updated 2 hours ago Andre from Green River switched with Jerry to Gainsco and saved $1016 2 hours ago Nell from Fairview switched with Jerry to Assurance America and saved $1138 2 hours ago Best car insurance companies for Volkswagen Tiguan S drivers with bad driving recordsLook—Jerry knows you’re not a bad driver. In fact, our research shows that nearly 50% of U.S. drivers would rate themselves as “great,” and over half of Americans believe they’re the best driver in their immediate family. But, well, stuff happens. And when that stuff hits the fan—whether it’s that speeding ticket you got while you were vibing to Beyonce’s new single or the DUI you picked up after that night of bad decisions in college—insurance companies are likely to raise your rates and even label you a “high-risk driver.” That label doesn’t have to define you—or your insurance policy. Jerry is a pro at navigating insurance premiums for high-risk drivers. No matter what your record looks like (or why it looks that way), Jerry won’t judge, and we won’t let insurance companies get away with overcharging you for coverage. Take a look at the table below to see how Jerry customers with previous infractions adjusted their rates.

Volkswagen Tiguan S driving record FAQsHow much does Volkswagen Tiguan S insurance go up after a DUI?If you get a DUI while driving your Tiguan S, you can expect your premium to increase by an average of 68%. How much does Volkswagen Tiguan S insurance go up after a speeding ticket? We’ve all been there. If you get a speeding ticket in your Tiguan S, your insurance premium could increase by an average of 4%. Best Car Insurance for Volkswagen Tiguan S by AgeIf you’re a young driver, you might feel like you need literal superpowers to find decent car insurance at a fair price. That’s because most insurance companies label drivers under age 25 as “high-risk drivers”—regardless of their actual driving record! The logic makes sense: because young drivers are less experienced, they tend to have statistically higher accident rates. Companies hike young drivers’ premiums to account for their perceived risk, even if their records are spotless. Feeling frustrated? We get it. Just because you’re young, that doesn’t mean you’re an unsafe driver—and it doesn’t have to mean overpaying for insurance. In fact, there are some simple ways to lower your rates as a young driver:

If you’re under 25, you could be paying as much as $3 more every month for your insurance. Below is a comparison of average rates Jerry customers saw, broken down by age. Best Car Insurance for Volkswagen Tiguan S by LocationMaybe you’ve got a perfect driving record and you’ve got a decent number of years behind the wheel. But your insurance premiums are still high—why? The answer might lie in your zip code. You see, insurance companies take location into account when you’re calculating your rates—and things like local crime rates, traffic accident statistics, and natural disaster records can cause rates to vary significantly from state to state and even between city blocks! It’s all about risk. If you live somewhere with high rates of auto theft, traffic accidents, or severe weather, the risk to your vehicle goes up. Where you see your neighborhood, your insurance company sees a higher chance of expensive claims, and they’ll factor that into your premium. So where can Volkswagen Tiguan S drivers find the lowest rates—and where can you expect higher-than-average premiums? Take a look at the breakdown below. Read about car insurance by state Driving a Volkswagen Tiguan SIf you own a Volkswagen Tiguan S , here’s what you need to know about your vehicle:

Key Takeaway: The more your Volkswagen Tiguan S is worth, the more you’ll pay to insure and drive it. Not driving aVolkswagen? Explore other popular cars:How can you save money on insurance for a Volkswagen Tiguan S?The average annual cost to insure a model is $2,731. But who says you have to be average? Here are a few hacks to help you save money on insurance. Compare ratesYou’ve heard it before: compare, compare, compare. When it comes to finding car insurance savings, comparison shopping is the name of the game. Here’s why it works: every insurance company uses a different algorithm to set your rate. Unless you have the ability to automatically detect the optimal algorithm for your vehicle, age, zip code, etc., the only way to find the right coverage at the best rate is to compare quotes. Actually, there is one other way—download the Jerry app, and let Jerry handle the algorithms (and the savings!) By answering a few simple questions, you can get instant access to Jerry’s pool of over 55 top insurance companies, and you’ll see rate comparisons in as little as 45 seconds! Invest in safetyWe mean that literally. Insurance companies often offer discounts to customers who install anti-theft devices and new safety technology in their vehicles. So get your [model] a GPS tracker or a collision avoidance system—you’ll improve your safety on the road and your insurance premium at the same time! Keep customization simpleLook, we get it: that cool add-on they showed you at the dealership really seemed worth the money. And maybe it is—but keeping extra features to a minimum is one of the easiest ways to save on insurance. That super-awesome upgraded sound system you fell in love with? Yeah, it’ll hike your rate. So will the leather upholstery, the heated seats, and the power moonroof. That’s because they increase your vehicle’s value, and with it the amount of any possible claims. So resist the urge to customize—unless it’s really worth the higher premium. Drive well to saveThat’s right, safe driving could literally put money back in your pocket. Not only will tickets send your rate skyrocketing, but you’ll set yourself up for discounts if you can maintain a totally clean record. If you’re close to that perfect clean record, try out a telematics program like Jerry’s Drive Well, Earn Perks to earn instant savings for your good on-road behavior. And if you’ve already got a driving history that’s, well, less than stellar, don’t despair: Jerry can still help you find low rates and improve your driving (and it’s all on your phone!). Go discount-huntingThe good news: most insurance companies offer discounts for everything from good grades and online payments to military service and safe driving. The bad news: companies won’t always tell you about their discounts, so you’ll have to go looking. Keep an eye out for the following common discounts:

Jerry can help you zero in on the best discounts for you—just ask about discounts when you’re comparing companies! Are Volkswagens more expensive to insure?If you are in the market for a new Volkswagen, it can be helpful to know what the average insurance costs by the different makes and models Volkswagen offers. That's because car insurance for Volkswagens tends to be slightly higher than the national average, which is $1,674 per year for a full coverage policy.

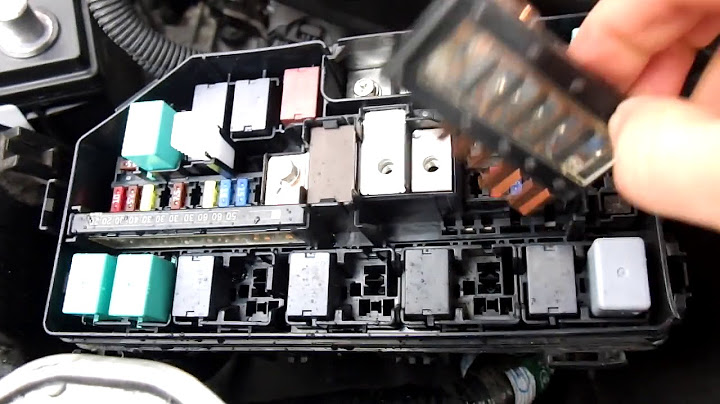

Is it expensive to maintain a Volkswagen Tiguan?The Volkswagen Tiguan has above average maintenance costs. It would cost you around $730 to maintain a Volkswagen Tiguan every year, which is notably more than the average of $521 annually for compact SUVs. A tune-up will be around $271, including the replacement of spark plugs.

Is insurance cheaper on a SUV than a car?While the average cost of an SUV far surpasses that of a sedan, car insurance costs may also differ substantially. Although rates will depend on your car insurance company and model, SUVs are typically $314 per year cheaper to insure than sedans.

Is Tiguan a reliable car?Is the Volkswagen Tiguan Reliable ? The 2022 VW Tiguan has a predicted reliability score of 76 out of 100. A J.D. Power predicted reliability score of 91-100 is considered the Best, 81-90 is Great, 70-80 is Average, and 0-69 is Fair and considered below average.

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 toptenid.com Inc.