|

SUPPLEMENTAL SECURITY INCOME (SSI) INCOME. WHY IS INCOME IMPORTANT IN THE SSI PROGRAM? . WHAT INCOME DOES NOT COUNT FOR SSI? . HOW DOES YOUR INCOME AFFECT YOUR SSI BENEFIT?. THE FOLLOWING EXAMPLES ARE BASED ON SAMPLE DOLLAR AMOUNTS: . EXAMPLE A – SSI Federal Benefit with only UNEARNED INCOME. EXAMPLE B – SSI Federal Benefit with only EARNED INCOME. EXAMPLE C – SSI Federal Benefit and STATE SUPPLEMENT with only UNEARNED INCOME. EXAMPLE D – SSI Federal Benefit and STATE SUPPLEMENT with only EARNED INCOME. HOW WILL WINDFALL OFFSET AFFECT MY BENEFIT?. WHEN DOES DEEMED INCOME APPLY?. WHEN DOES DEEMED INCOME NOT APPLY? . Show

Top 1: Understanding Supplemental Security Income SSI Income - SSAAuthor: ssa.gov - 103 Rating

Description: SUPPLEMENTAL SECURITY INCOME (SSI) INCOME. WHY IS INCOME IMPORTANT IN THE SSI PROGRAM? . WHAT INCOME DOES NOT COUNT FOR SSI? . HOW DOES YOUR INCOME AFFECT YOUR SSI BENEFIT?. THE FOLLOWING EXAMPLES ARE BASED ON SAMPLE DOLLAR AMOUNTS: . EXAMPLE A – SSI Federal Benefit with only UNEARNED INCOME. EXAMPLE B – SSI Federal Benefit with only EARNED INCOME. EXAMPLE C – SSI Federal Benefit and STATE SUPPLEMENT with only UNEARNED INCOME. EXAMPLE D – SSI Federal Benefit and STATE SUPPLEMENT with only EARNED INCOME. HOW WILL WINDFALL OFFSET AFFECT MY BENEFIT?. WHEN DOES DEEMED INCOME APPLY?. WHEN DOES DEEMED INCOME NOT APPLY? .

Matching search results: Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, ...Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, ... ...

Top 2: What Types of Income Do You Have to Report to Social Security?Author: scullydisabilitylaw.com - 156 Rating

Description: SSD Benefits Monthly Income Limit. Changes Required to Be Reported for SSDI Income You Are Required to Report. Reporting Income Does Not Always Reduce Your SSD Benefits. Report Disability-Related Expenses to SSD (Allow Higher Earnings) Qualifying for Social Security Disability (SSD or SSDI) benefits means you met the government’s definition of a disabled worker because you suffer from any medically determinable physical or mental impairment that prevents you from performing a substantial gain

Matching search results: Oct 25, 2021 · There are two kinds of income you are required to report to the SSD benefits program, earned income and unearned income. Earned income is any ...Oct 25, 2021 · There are two kinds of income you are required to report to the SSD benefits program, earned income and unearned income. Earned income is any ... ...

Top 3: What Types of Income Do You Have To Report To Social Security ...Author: clausonlaw.com - 174 Rating

Description: A look at the two disability programs administered by Social Security. Four Different types of income. Income and the SSI program. Reportable income under the SSDI program. Trial. work periods and reporting income. Learn more about how to report income to SSD The Social Security Administration oversees two programs, Social Security Disability Insurance and Supplemental Security Income, that pay monthly benefits to disabled individuals who qualify for them. Each program has other qualifying crite

Matching search results: Oct 29, 2021 · Reporting types of income to SSD generally focuses on wages from employment at a job and income earned through self-employment. If you earn more ...Oct 29, 2021 · Reporting types of income to SSD generally focuses on wages from employment at a job and income earned through self-employment. If you earn more ... ...

Top 4: Regular & Disability Benefits | Internal Revenue ServiceAuthor: irs.gov - 159 Rating

Description: AnswerSocial security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of. Form 1040, U.S. Individual Income Tax Return or Form 1040-SR,. U.S. Tax Return for Seniors. The taxabl

Matching search results: Oct 7, 2022 · Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is ...Oct 7, 2022 · Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is ... ...

Top 5: Is Social Security Disability Income Taxable? - TurboTax - IntuitAuthor: turbotax.intuit.com - 160 Rating

Description: File 100% FREE with expert help. Taxes on disability income.. What is Social Security Disability Insurance?. Who's eligible for Social Security Disability Insurance?. What benefits does Social. Security Disability Insurance offer?. Is Social Security disability taxable?. What is Supplemental Security Income?. TaxCaster Tax Calculator. Tax Bracket. Calculator. W-4 Withholding Calculator. Self-Employed Tax Calculator. Self-Employed Tax Deductions Calculator TopUpdated for Tax Year 2022 • December 1

Matching search results: Dec 1, 2022 · Is Social Security disability taxable? · As a single filer, you may need to include up to 50% of your benefits in your taxable income if your ...Dec 1, 2022 · Is Social Security disability taxable? · As a single filer, you may need to include up to 50% of your benefits in your taxable income if your ... ...

Top 6: What's included as income - HealthCare.govAuthor: healthcare.gov - 109 Rating

Description: Count income & household size. What to include as income. Whose income to include in your estimate. What income is counted. Report income changes to the Marketplace Count income & household sizeMore infoHow to estimate your expected incomeWho to include in your householdWhat to include as incomeWhat to include as incomeWhen you fill out a Marketplace application, you’ll need to estimate what your household income is likely to be for the year.. Marketplace savings are based on your expected h

Matching search results: Include both taxable and non-taxable Social Security income. Enter the full amount before any deductions. Social Security Disability Income (SSDI). Yes. But do ...Include both taxable and non-taxable Social Security income. Enter the full amount before any deductions. Social Security Disability Income (SSDI). Yes. But do ... ...

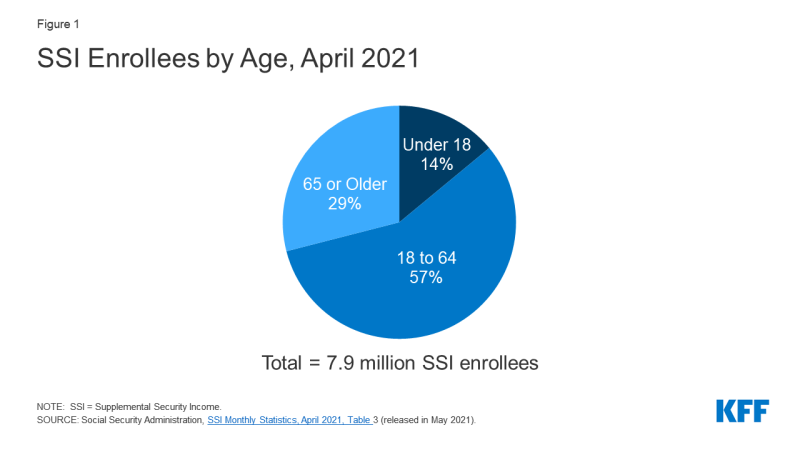

Top 7: Supplemental Security Income for People with Disabilities - KFFAuthor: kff.org - 188 Rating

Description: How does a person qualify for SSI?. How has the COVID-19 pandemic and associated economic downturn affected SSI and Medicaid?. Implications for Medicaid The federal Supplemental Security Income (SSI) program provides a cash payment to serve as a minimum level of income for people who have low incomes and limited assets and are elderly or meet the Social Security Administration’s (SSA) strict rules that define disability. The maximum federal SSI benefit is less than the federal poverty level (FP

Matching search results: Jun 23, 2021 · To qualify, SSI enrollees must have low income, limited assets, and either be age 65 or older or have an impaired ability to work at a ...Jun 23, 2021 · To qualify, SSI enrollees must have low income, limited assets, and either be age 65 or older or have an impaired ability to work at a ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 toptenid.com Inc.