Before applying for a credit card, ask yourself this important question: How likely am I to be approved? Show

There are two reasons why that question matters. First, understanding the odds of being approved for a credit card can save you time. You can narrow your search for a card to the ones for which you’re most likely to qualify and avoid the ones for which you don’t. Second, limiting your credit card applications can minimize negative impacts on your credit score. Each new inquiry for credit can knock a few points off your score, so the fewer cards you apply for, the better. But what does it take to be approved for a credit card? And are there things you can do to increase your approval odds if you’re new to using credit or you’re attempting to rebuild your credit history? This guide explains everything you need to know about credit card approval. Key Takeaways

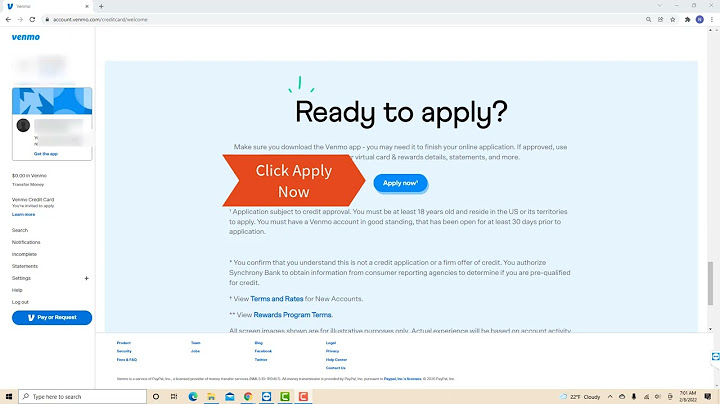

Click Play to Learn About Credit Card Applications and ApprovalBefore Applying for a Credit Card, Know the Credit Score RangesWhen you’re applying for a credit card, companies take several factors into account, including:

Of those three, your credit score carries the most weight in credit card approval decisions. One way to evaluate your odds of being approved is by checking your credit scores in advance. FICO credit scores, which are the scores used by 90% of top lenders, range from 300 to 850. Mike Pearson, credit expert and founder of the credit repair site Credit Takeoff, explains how the score ranges affect your approval odds. “If you have a credit score of 750 and above, you’ll have your choice of nearly any credit card on the market, including ‘prime’ cards, which feature premium rewards and perks,” Pearson says. “Your credit score isn’t the only thing that goes into getting approved for a card like that—and you could still get rejected on the basis of a too-high credit utilization ratio or a recent late payment—but if you have an excellent credit score, you stand the best chance of getting approved for most prime cards.” At the other end of the spectrum is the “poor” credit score range, which is a score below 580. If your score is in this range, Pearson says your best bet for getting approved for a credit card is a secured card. “With a secured credit card,” Pearson explains, “you make a down payment or deposit cash into an account when you sign up for the card. This deposit acts as collateral.” If you fail to pay the bill, the credit card company can use your deposit to cover the balance. The average FICO score was 716 as of August 2021, according to an annual update published by FICO. That is eight points higher than a year earlier, an improvement that the company attributed to accommodations by lenders to those affected by the COVID-19 pandemic. Your credit score determines the rate of interest you'll pay. If your score is low, you'll pay a higher interest rate. Who’s More Likely to Be Approved for a Credit Card?Based on credit scores alone, it’s not surprising that people with the best credit scores also have the best chances of being approved for a card. A 2021 report from the Consumer Financial Protection Bureau found a strong correlation between credit scores and approval rates:

There are a couple of conclusions to draw from those numbers. As Pearson mentioned, it’s possible to have an excellent credit score and still be turned down for a credit card. It’s also possible to qualify for a credit card even when you have no credit at all, which is encouraging if you’re just beginning to establish your credit history. Improve Your Odds of Being Approved for a CardRegardless of whether you have excellent or fair credit, there are steps you can take to raise your chances of being approved for a new credit card offer. Check Your Credit Report and ScoreIf you haven’t checked your credit report and scores yet, this is a good place to start when trying to improve your odds of getting a credit card. Your credit report is a collection of information that’s used to calculate your credit scores. This includes things such as payment history, account balances, inquiries for new credit, delinquencies, and public records. You can get your credit report for free once per year from the three main credit bureaus, Experian, Equifax, and TransUnion, through the AnnualCreditReport.com website. If you’ve never checked your credit report before, it may be helpful to get all three reports at the same time to see how your credit history compares. You may have a creditor that reports to only one bureau instead of all three, for example, which could affect your credit score. As you review your reports, check to make sure all the information is correct. If you see an error or inaccuracy, you have the right to dispute it with the credit bureau that’s reporting the information. If the bureau verifies that an error exists, it is legally required to remove it or correct it, either of which could add a few points back to your score. Practice Healthy Credit Score HabitsFor FICO score calculations, two factors, in particular, carry the most weight: payment history and credit utilization. Credit utilization is how much of your credit limit you’re using at any given time. Knowing how to manage these two factors is key to improving your credit score. “Your payment history is the number one thing that goes into calculating your credit score,” Pearson says. “Just one late or missed payment can send your credit score down by more than 50 points.” You can avoid that scenario by making your payments on time every month. If you struggle to manage due dates, automating payments from your bank account can simplify the bill payment process. Alternately, you could set up alerts through your bank or with your billers to let you know when a due date is approaching. If you already have one or more credit cards, maintaining low balances can also help your score. “Most lenders like to see your credit utilization number at 30% or below,” Pearson says. Paying down your current balances can improve your utilization ratio. Another option is requesting a credit limit increase on your cards. By increasing your available credit limit, you improve your utilization ratio, assuming you don’t make any new purchases against the higher limit. Compare Card Offers Carefully Before ApplyingCredit card companies routinely change their credit card offers. While they may not explicitly state what minimum credit score they’re looking for from consumers, many of them do give a general range that indicates who the card is suited for. For example, a credit card company might offer a cash-back card with one rewards rate for consumers with good or fair credit and reserve a card with a higher cash-reward rate or better perks for consumers who have excellent credit. Taking time to do your homework and research card options can help you narrow the field to the cards for which you’re best suited, based on your credit profile. From there, you can streamline the list further by determining which cards best fit your needs. For instance, if you carry a balance, you may prefer a card that offers a low annual percentage rate (APR) on purchases. Or you might be interested in a card that offers travel miles or points rather than cash-back rewards. Remember to look beyond credit scores and consider the other requirements a lender may set, such as a minimum income threshold. Also, check the card options your bank offers against what other banks advertise. I f you have a positive banking history with your bank or credit union, you may find it easier to qualify for a card. In any case, take the time to review the APR and fees of any card you consider, so you know what the card will cost you. Try Other Credit-Building Options If You’re Deniedif you aren’t able to get approved for a credit card, don’t lose hope. You may have to work a little harder to raise your credit score. In the meantime consider other options for using credit, such as a secured credit card or a credit-builder loan. These are small personal loans you can use to establish and/or build credit by making timely payments. If you’re unable to get approved for a card because you’re under 21, the age limit for getting credit cards imposed by the 2009 CARD Act, you could try the authorized user route. This involves asking your parents to add you to one of their cards as an authorized user. You wouldn’t be responsible for any debt incurred on the card, but you could reap the benefits of their responsible card

use. This could be a stepping stone to getting approved for a card of your own down the line. The Bottom LineBeing approved for a credit card can take time if you don’t have a lengthy credit history or your credit score is recovering from a past mistake. Remember to be patient when building credit, as it can take time for your efforts to be reflected in your credit score. In the meantime, continue practicing good credit habits (such as paying bills on time) and consider enrolling in a free credit monitoring service to track your progress from month to month. You can also select from one of the best credit monitoring services available. Can you decline a credit card after being approved?You can't decline a credit card after being accepted, but you can always cancel your new credit card if you don't want the new credit account.

Do I have to accept a credit card if I get approved?The bottom line. If you decide you don't want to hold on to a credit card after applying and being approved by the issuer, you can still cancel your account. Think a bit about the consequences before you cancel. If you do decide to cancel, make sure to get a written confirmation of the account closing.

What if I get approved for a credit card and don't use it?While not using your card can help your utilization, it may impact your account status. If you don't activate a credit card and thus don't use the card, your account may be closed. Card issuers typically close accounts that aren't used within a certain time period, usually over a year.

Can I cancel a credit card before activating it?Can you cancel a credit card before activating it? You can cancel a credit card before activation. The activation process has nothing to do with your account being open, so you can simply call the number on the back of your credit card.

|

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 toptenid.com Inc.